Vires Finance announced on May 25th that there is a new locking mechanism for supplying liquidity into the protocol. Basically, you may now lock your funds in limited time periods like 3, 6, and 12 months to earn boosted APY on VIRES rewards.

Enno Wallet users are already experienced such locking mechanisms before and it looks like this system is getting more popular to make investors make more profit while keeping the protocol more stable. As you may remember, lately VIRES token itself switched to long-term investment, and only those who lock VIRES started to get a share of the protocol revenue.

Most of our users who have investments in Vires Finance are curious about when this new locking mechanism is also supported by Enno Wallet. Unfortunately, it will take a while for us to make this integration, and perhaps there is a possibility that this function will never make it into Enno Wallet. So for now, whenever you supply funds to Vires Finance from your Enno Wallet, your investment will have no lock and you will withdraw your supplied amount or less whenever you want unless there is a liquidity problem in the specific pool where your supply is made.

Let’s see what has changed in Vires Finance:

Locking Liquidity is more profitable now

VIRES’ daily distribution has been rearranged. Providers who lock their supply for a certain time benefit more and they share daily 225 VIRES. Meanwhile, regular providers who have no lock only share 25 VIRES daily. Borrowers have no share at all.

Choosing between time periods

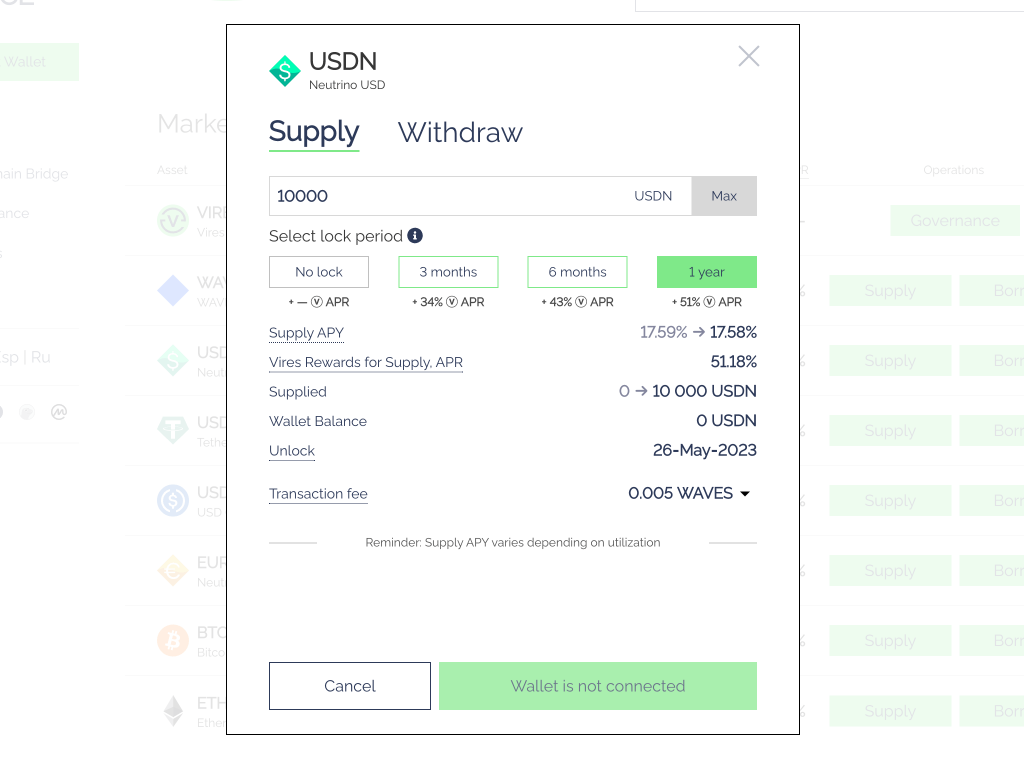

The new mechanism offers three different time periods to lock your supplied amount. These are 3 months, 6 months, and 12 months time periods. As you may guess, if you choose a longer time period, your share gets bigger with it.

The math of Vires Finance is as follows:

— 1.25X more if you lock for 6 months compared to 3 months.

— 1.50X more if you lock for 12 months compared to 3 months.

Is it possible to extend your lock?

You may also supply new liquidity to the pool anytime. In terms of this, we may say that the new locking mechanism is pretty much user-friendly and has not had any strict rules when it comes to supplying more funds to the protocol.

How do you withdraw your liquidity when the locking duration is done?

The magical phrase is when the lock is exhausted. Your funds will be released when the chosen time period is completed and the protocol will give you three options.

Option 1: withdraw assets to wallet with respect to current withdrawal limits and liquidity availability;

This option indicates that today’s liquidity issues may continue. The official announcement especially underlines the withdrawal limits and liquidity availability.

Option 2: export as LP tokens;

This option lets you transform your investment into Liquidity Pool tokens.

Option 3: migrate to regular supply;

This option gives you the possibility to be a regular provider again. So, you will keep your liquidity but you will not get any boosted APY as well as locking duration.

You may anytime visit the Vires Finance website here and check what is the specific boost according to the time period on a particular cryptocurrency. Below is showing the USDN Supply Screen. The ‘Select lock period‘ lets you choose the duration of the lock, while the ‘Vires Rewards for Supply, APR‘ is showing the boost ratio on this lock.

Additional Notes

We highly suggest you read the official announcement from Vires Finance named ‘Boost VIRES Rewards by locking Liquidity‘ before making any decision to lock your liquidity for a certain time period.