Forex with

Stablecoins

A reliable solution for addressing the high

volatility in the crypto asset trading.

What is

Algorithmic Stablecoin

An algorithmic stablecoin is a representation of what true decentralization looks like, without any regulatory bodies to maintain or watch over the proceedings, as the code is what is responsible for both the supply as well as the demand, alongside the target price.

These foundational benefits offer a scalable solution that is not actually offered by any other set on the market as of now, and the absence of the tangible asset requirement behind algorithmic stablecoin eliminates the possibility of errors from the user’s end.

Source: https://coinmarketcap.com/alexandria/glossary/algorithmic-stablecoin

What is

Fiat-collateralized Stablecoin

Stablecoins bridge the worlds of cryptocurrency and everyday fiat currency because their prices are pegged to a reserve asset like the US dollar or gold. This dramatically reduces volatility compared to something like Bitcoin and results in a form of digital money that is better suited to everything from day-to-day commerce to making transfers between exchanges.

The combination of traditional-asset stability with digital-asset flexibility has proven to be a wildly popular idea. Billions of dollars in value have flowed into stablecoins like USD Coin (USDC) as they’ve become some of the most popular ways to store and trade value in the crypto ecosystem.

Stablecoins

in Enno Wallet

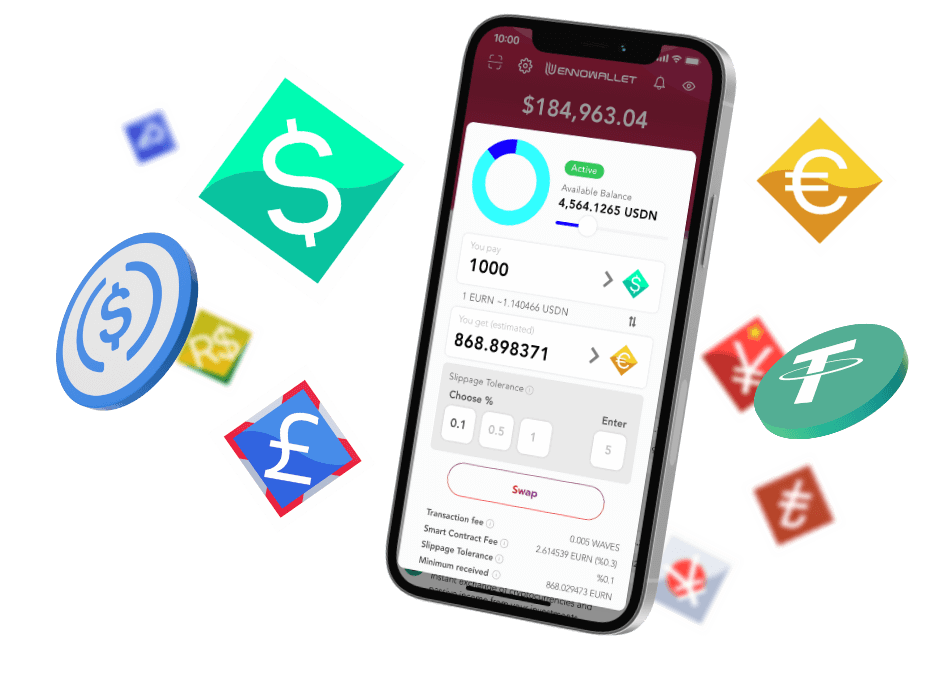

We are bringing old markets to the new world. Decentralized ForEx (DeFo) is available in Enno Wallet, providing effective tools for swapping stable assets via smart contract. Smart contract ensures reliability, transparency, and virtually unlimited liquidity at a predetermined rate.

USDN

Neutrino USD (USDN) is an algorithmic crypto-collateralized stablecoin pegged to the US dollar. All operations involving USDN, such as issuance, collateralization, staking, and reward payouts, are transparent and governed by a smart contract.

USDC

USD Coin (USDC) is a stablecoin that is pegged to the US dollar on a 1:1 basis. Every unit of this cryptocurrency in circulation is backed up by $1 that is held in reserve, in a mix of cash and short-term US Treasury bonds.

USDT

Tether (USDT) is a stablecoin that mirrors the US dollar. It is achieved via maintaining a sum of commercial paper, fiduciary deposits, cash, reserve repo notes, and treasury bills in reserves that is equal in USD value to the number of USDT in circulation.

EURN

Neutrino EUR (EURN) is an algorithmic crypto-collateralized stablecoin that mimics the price of the European Union’s Euro. The token is issued on the Waves blockchain by the Neutrino project.

GBPN

Neutrino GBP (GBPN) is an algorithmic crypto-collateralized stablecoin that mimics the price of the British Pound. The token is issued on the Waves blockchain by the Neutrino project.

JPYN

Neutrino JPY (JPYN) is an algorithmic crypto-collateralized stablecoin that mimics the price of the Japanese Yen. The token is issued on the Waves blockchain by the Neutrino project.

CNYN

Neutrino CNY (CNYN) is an algorithmic crypto-collateralized stablecoin that mimics the price of the Chinese Yuan. The token is issued on the Waves blockchain by the Neutrino project.

TRYN

Neutrino TRY (TRYN) is an algorithmic crypto-collateralized stablecoin that mimics the price of the Turkish Lira. The token is issued on the Waves blockchain by the Neutrino project.

RUBN

Neutrino RUB (RUBN) is an algorithmic crypto-collateralized stablecoin that mimics the price of the Russian Ruble. The token is issued on the Waves blockchain by the Neutrino project.

UAHN

Neutrino UAH (UAHN) is an algorithmic crypto-collateralized stablecoin that mimics the price of the Ukranian Hryvnia. The token is issued on the Waves blockchain by the Neutrino project.

BRLN

Neutrino BRL (BRLN) is an algorithmic crypto-collateralized stablecoin that mimics the price of the Brazilian Real. The token is issued on the Waves blockchain by the Neutrino project.

Using Algorithmic Stablecoins for Foreign Exchange

Stablecoins are pegged to the value of local currencies and they are fully collateralized by Waves tokens. A network of secure oracles is constantly supplying up-to-date prices from fiat foreign exchanges. For example, exchanging USDN/EURN rates are always equal to real-world USD/EUR rate.

DeFo is

transparentand decentralized

You can always check the collateral levels from blockchain. All operations involving USDN, such as issuance, staking and reward payouts, are fully transparent and governed by a smart contract.

DeFi Platforms

in Enno Wallet

You may use one of these DeFi Platforms in Enno Wallet to get your stablecoin by exchanging your current assets.

What is Next

See Other Features

Enno Wallet has much more to offer.

Please be sure to check all other features.