Neutrino protocol is one of the most loved financial instruments in the Waves ecosystem and it is highly suggested that you read this article before deciding to use staking feature for NSBT in Enno Wallet.

What is Neutrino Protocol?

Basically, the Neutrino protocol is an algorithmic price-stable assetization protocol that enables the creation of stable coins tied to real-world assets or cryptocurrency. The Neutrino system relies on 3 core tokens: WAVES, USDN and NSBT. You may visit here to see the details of the system.

What is NSBT?

NSBT (stands for Neutrino System Base Token) is a recapitalization and governance token for the Neutrino system. As a recapitalization token, NSBT ensures the stability of collateral reserves on Neutrino’s smart contract. New NSBTs are issued for locking ‘WAVES’ on a contract, serving as additional backing and insuring the system against the deficit.

What is NSBT Staking?

Neutrino protocol has announced in December 2020 that they allow users to receive rewards in USDN and ‘WAVES’ for storing NSBT tokens at the Neutrino smart contract address.

If you are not sure what is staking in overall, you may visit here for more information.

This feature aims to increase the stability of the collateral reserves on the smart contract by further stimulating NSBT issuance and holding.

How was it before?

When the NSBT staking feature was first announced, it was different than today. You were ready to stake your NSBTs after acquiring it from Enno Wallet’s interface. Staking NSBT was simply sending your tokens to a smart contract and it was as easy as entering an amount and tapping the stake button. Moreover, you were getting ready to collect your staking rewards right away. Besides, the profitability of NSBT staking depended on the volume of WAVES-USDN swaps and a user’s staking balance’s share in the total amount of staked NSBTs.

The best part was that you were able to get your NSBT back anytime without a loss of your staked amount (principal).

What has changed?

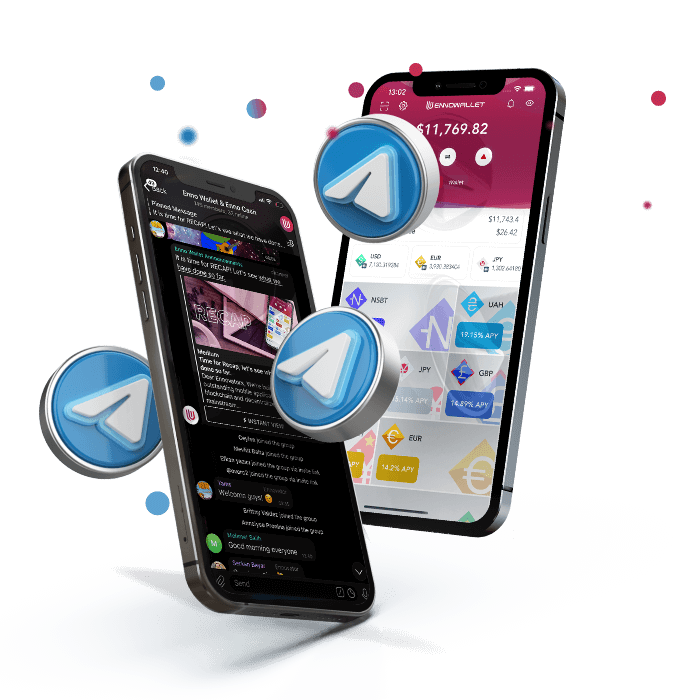

The base of staking NSBT stayed mostly the same. You still should have NSBT from Enno Wallet by swapping with various tokens. Besides, your NSBTs still go to a smart contract when you enter an amount and tap the stake button. However, Neutrino protocol underwent a number of changes in order to achieve decentralized structure. So, they changed the mechanics of NSBT and swap operations. NSBT staking transformed into a long-term investment and you will get gNSBT every time you stake an NSBT token.

Here are the changes with key points:

- Automatic reward payments for NSBT staking were canceled. Users will manually claim rewards.

- Only owners of gNSBT will receive rewards — a percentage of collected ‘WAVES’ ↔ USDN swap fees (the protocol fee).

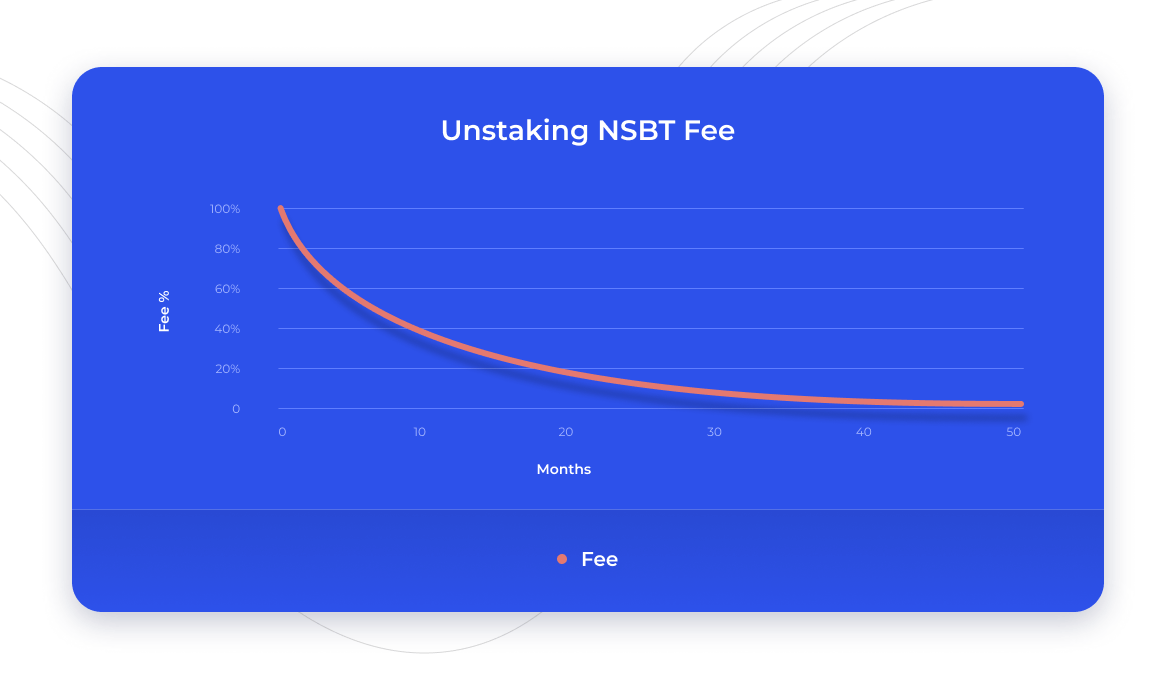

- Unstaking your NSBT has cost — a percentage of the unstaked NSBT amount per fee curve (half-life function).

- NSBT stakers will receive “voting right” (gNSBT) in 1 to 1 proportion.

- Voting in the Neutrino protocol can only be done with gNSBT.

Here is the important part about the new NSBT staking which you should give full attention to. Transforming your NSBT to gNSBT comes with great benefits and a big responsibility. gNSBT has an unstaking fee and this fee decreases over time. The sooner you unstake your funds, the more of your NSBT you lose.

As the simplest example, if you unstake your NSBT within a day of your stake, you will lose all of your NSBT! As a real-life example, this looks like a term deposit account in today’s banking system. Your money should be locked up for some set period of time to get the promised interest rate.

What is gNSBT?

gNSBT is a new entity to split users’ balance of “votes” and NSBT balance. Votes (gNSBT) will be used during the governance process. When you do stake your NSBT it will be converted to gNSBT for the duration of your staking. gNSBTs will automatically be converted back to NSBT when you unstake.

Also, owners of gNSBT receive rewards as a percentage of collected swap fees a.k.a the protocol fees. The amount of reward is proportional to the user’s gNSBT share. When staking/unstaking NSBT, the user’s amount of gNSBT is recalculated.

What do you mean by long-term commitment?

Currently, you need to keep your staking for at least 4 years to not pay almost any unstaking fee. This time term may change in the future with the votes of gNSBT holders.

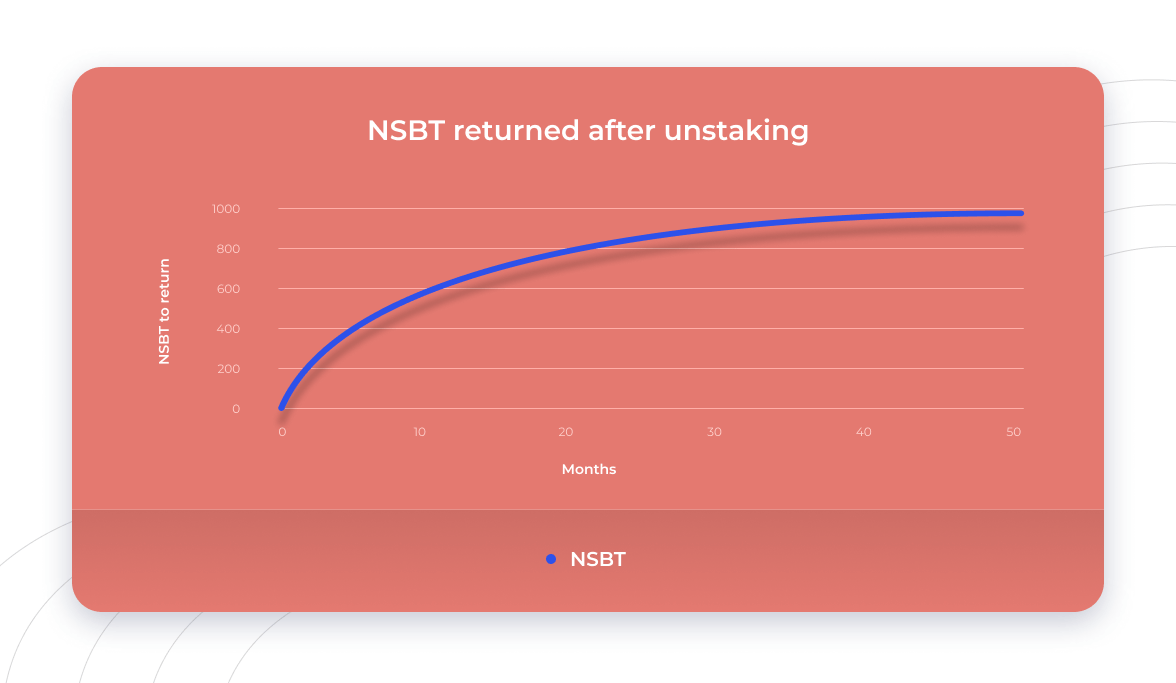

Let’s assume your staking is 1,000 NSBT.

If you unstake your NSBTs in 1 month (43,200 blocks), the contract will charge a 89.09% fee, meaning that you will receive only 109.101 and lose the ownership of the rest of it.

If you may wait 20 months (864,000 blocks), the contract will charge a 9.92% fee, meaning that your receiving back amount is going to be 900.787.

As you may see also below graphics, it is important to keep staking period longer since the sooner you unstake your NSBT, the more you will pay as unstaking fee.

Please check the Fee Curve section of the official announcement here for more information.

Why you shouldn’t unstake your NSBT right away?

As we have said earlier, you need to wait until the investment period is completed. Otherwise, you may lose all of your NSBT. This is a critical difference from the previous staking feature of NSBT and you should understand that Neutrino Protocol is no longer available for short time investments.

Additional Notes

Let’s repeat once more, you get an amount of gNSBT equal to staked NSBT when you invest in NSBT staking.

gNSBT is not a token but it’s the unit that defines your voting power and most importantly your share in the revenue distribution from protocol fees. The more gNSBT you have, your vote and reward will get stronger.

Most importantly, NSBT staking is a long-time investments instrument with commission decreasing by the half-life formula.