We would like to clarify the withdrawal error on Vires Finance while you are using the Enno Wallet and want you to know we totally understand and share how the situation can be frustrating. In this article, we will share details about the latest situation and the progress it has been made.

Why do you get an error message when you try to withdraw USDT and USDC from Vires Finance on Enno Wallet?

The error message comes from the smart contract which belongs to Vires Finance. Enno Wallet has no control over this smart contract. If you are getting this error message below, you should know that the withdrawal is suspended.

An Error Occured

Error while executing account-

script:

FailedTransactionError(code = 1,

error = not enough liquidity:

funds in use, log

i= Invocation(

originCaller = Address

bytes

base58′[your-wallet-addres-starts-with-3P]’

on

9.1

18.6C

payments = 1).

Why some withdrawals are suspended on Vires Finance?

Vires Finance is managed with smart contracts. Every transaction has a rule and this makes the whole system secure and sustainable. It appears that all USDC and USDT amounts in the pools have gotten borrowed and that’s why there is not enough amount to withdraw from these assets. This will prevent the suppliers withdraw their supplied amount until the balance is established again.

How you may withdraw your assets from Vires Finance?

If you are getting an error message while the withdrawal transaction, it means you may only withdraw your asset when there is enough amount in the pool. This may happen when some borrower brings a borrowed amount back or a supplier makes a new deposit to the pool.

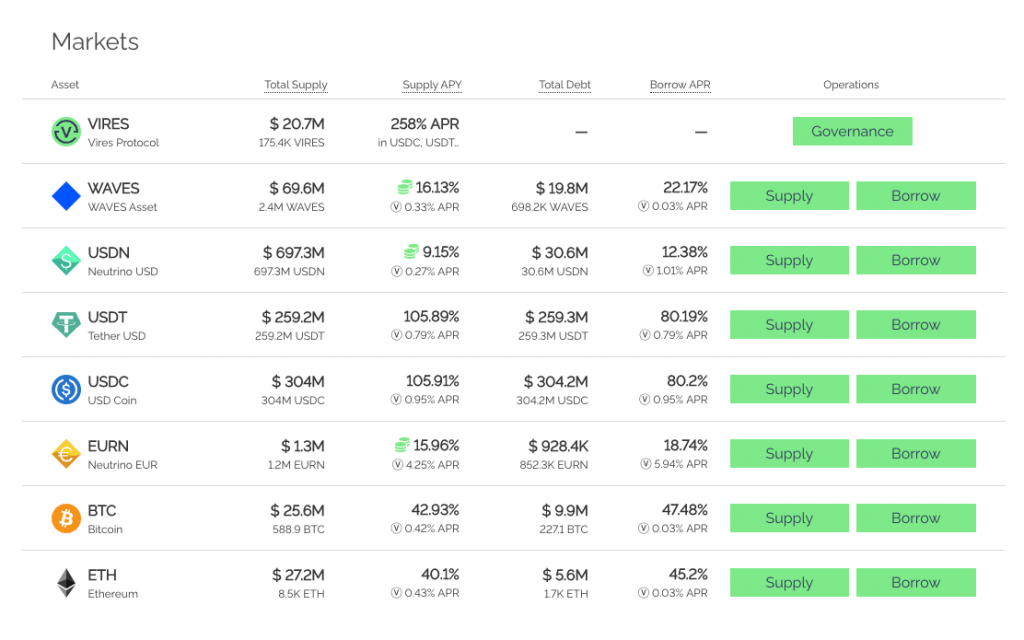

You may anytime check the amount of the pool by simply visiting Vires Finance website here and checking the Markets section. You will see the assets and numbers under the specific titles. The Total Supply and the Total Debt are crucial. When the total supply of the specific asset, is bigger than the total debt of it, you may withdraw the difference.

Voting on Vires.Finance

Community of Vires Finance is currently voting on a temporary change of liquidation threshold and maximum borrow APR.

Here are the proposal and voting details:

Proposal Title: Set WAVES/USDN/EURN Liquidation Threshold to 1, Max Borrow APR for all assets to 400

Details: In order to prevent price manipulation and protect the ecosystem, it is proposed to temporarily reduce the liquidation threshold for Waves and USDN borrowing to 0.1%. Also, it is proposed to limit the maximum borrow APR to be 40%.

If you have staked VIRES before, you may join this voting until April 10, 2022, 15:39 CET by simply visiting this link and connecting with your wallet address.

You may read the community comments on the proposal here. This may help you understand the proposal better and make your voting accordingly.

What may change with the voting?

If this voting will pass with approval by the community, changing the liquidation threshold to 1 will cause all accounts credited with higher than 0.1% debt of WAVES/USDN/EURN to Vires Finance to get liquidated. The proposal doesn’t lead to full liquidation of all accounts that have borrowed WAVES/USDN/EURN.

Here’s an example from Vires Finance about liquidation:

Let’s take an account that has supplied 100 USDC and borrowed 40 USDN (net value = $60). Upon liquidation, up to 40 of USDN debt can be liquidated for up to 42 (= 40 * (1 + 0.05)) USDC. So, the net value would become $58.

Another part of this voting is about lowering the APR.

If this voting will pass with approval by the community, 105% APY will be over soon. Lowering APR will cap borrow rates to around 40%.

Voting will end on April 10, 2022. Please watch the voting process carefully. If you borrowed WAVES/USDN/EURN you still have time to bring back your loan to avoid liquidation.

Additional Notes

It should be clear that everybody on Vires Finance works to make progress. We believe, this withdrawal issue will be concluded soon. We highly suggest you read the official announcement from Vires Finance named ‘The Liquidity squeeze: What’s happening and what’s next?‘